Weight Loss Surgery Insurance Secrets

For many individuals struggling with obesity and related health issues, weight loss surgery can be a life-changing solution. However, navigating the complex world of insurance coverage for these procedures can be a daunting task. In this comprehensive blog post, we’ll unveil the secrets to successfully obtaining insurance approval for weight loss surgery, from understanding the different types of procedures to effectively demonstrating medical necessity.

Understanding the Basics of Weight Loss Surgery Coverage

The first thing to understand is that most insurance providers do consider weight loss surgery a medically necessary procedure, rather than a purely cosmetic one. This means that if you meet certain clinical criteria, your plan should provide some level of coverage. However, the details of that coverage can vary significantly depending on your specific insurance plan.

Some key factors that influence weight loss surgery coverage include:

- Your body mass index (BMI) – Most insurers require a BMI over 40, or over 35 with obesity-related health conditions.

- Proof of prior weight loss attempts: Insurance usually mandates you’ve tried and failed to lose weight through diet and exercise first.

- Required pre-approval or pre-authorization processes – Insurers want to assess if the surgery is medically necessary for you.

- Covered procedures – Plans may only cover certain types of bariatric surgeries like gastric bypass or sleeve gastrectomy.

- Deductibles, copays, and out-of-pocket maximums – You’ll likely have to pay some portion of the costs out-of-pocket.

It’s crucial to thoroughly review the details of your specific insurance plan to understand exactly what is and isn’t covered when it comes to weight loss surgery. Don’t assume anything – get the specifics directly from your provider.

Navigating the Pre-Approval Process

One of the most important and challenging steps in getting weight loss surgery covered is the pre-approval or pre-authorization process required by most insurers. This is where you’ll need to provide extensive documentation to demonstrate that you meet the clinical criteria for coverage.

The documentation you’ll typically need to submit includes:

- Medical records showing your weight history, BMI, and any obesity-related health conditions

- Documentation of prior attempts at weight loss through diet, exercise, and medically supervised programs

- Letters of medical necessity from your primary care physician and/or bariatric surgeon

- A detailed treatment plan outlining the proposed surgical procedure and expected outcomes

The pre-approval process can be time-consuming and often requires significant back-and-forth communication with your insurance provider. It’s crucial to be organized, persistent, and advocate strongly for your case. Don’t get discouraged if your initial claim is denied – many patients have to go through the appeals process to get approval.

How to Get Insurance to Pay for Weight Loss Surgery: Key Secrets

Know Your Policy Inside and Out:

The first step in unraveling the mysteries of weight loss surgery insurance coverage is to thoroughly review your policy. Take the time to understand what is covered, what isn’t, and any specific requirements or limitations that may apply to weight loss procedures. Pay close attention to terms like “medically necessary” and “cosmetic,” as these distinctions can have a significant impact on coverage eligibility.

Document Medical Necessity:

Many insurance companies require documentation of medical necessity to approve coverage for weight loss surgery. This typically involves providing evidence that you have attempted other methods of weight loss without success and that surgery is medically necessary to improve your health and quality of life. Keep detailed records of your weight loss journey, including diets, exercise programs, and any medical conditions exacerbated by obesity, to support your case.

Explore Different Procedures:

Insurance companies do not treat all weight loss procedures equally. While they commonly cover procedures like gastric bypass and gastric sleeve surgery, they may consider others experimental or elective and may not cover them under your policy. Research the various types of weight loss surgery available and consult with your healthcare provider to determine which option is best for you and most likely to be covered by your insurance.

Understand Pre-authorization Requirements:

Many insurance companies require preauthorization before they will approve coverage for weight loss surgery. This involves submitting a detailed treatment plan to your insurance provider for review and approval prior to scheduling the procedure. Failure to obtain preauthorization can result in denied coverage and unexpected out-of-pocket expenses, so be sure to follow the proper protocol outlined by your insurance company.

Appeal Denied Claims:

If your insurance company denies coverage for weight loss surgery, don’t lose hope. You have the right to appeal their decision and present additional evidence to support your case. This may include letters from your healthcare providers, medical records, and other documentation demonstrating the medical necessity of the procedure. Be persistent and don’t be afraid to enlist the help of a healthcare advocate or legal professional if necessary.

Explore Alternative Financing Options:

In some cases, even with insurance coverage, out-of-pocket expenses for weight loss surgery can be substantial. If you find yourself facing significant financial barriers, don’t despair. Explore alternative financing options such as medical loans, payment plans, or assistance programs offered by hospitals and nonprofit organizations to help offset the cost of treatment.

Which Insurance is Best for Bariatric Surgery?

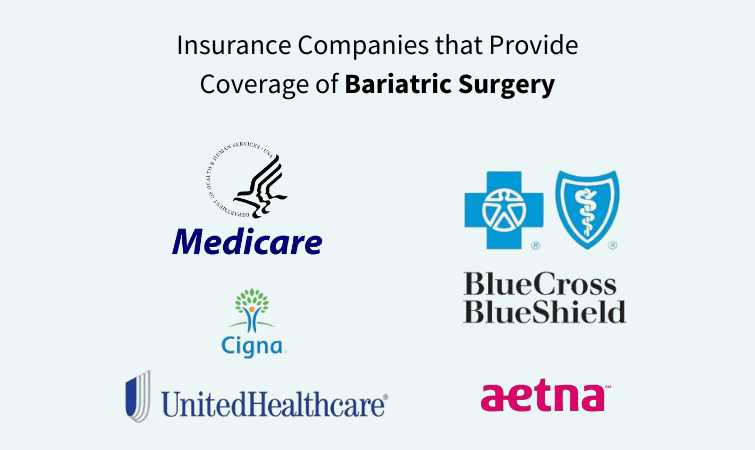

Determining the “best” insurance for bariatric surgery depends on various factors such as your individual needs, location, and available options. However, some insurance providers offer comprehensive coverage and support for bariatric procedures. Here are a few insurance companies that provide coverage of bariatric surgery:

- Medicare: Medicare covers bariatric surgery for individuals who meet certain criteria, such as having a Body Mass Index (BMI) over 35 and experiencing related health problems like type 2 diabetes or hypertension.

- Medicaid: Medicaid coverage for bariatric surgery varies by state, but many states provide coverage for eligible individuals who meet specific criteria. It’s essential to check with your state’s Medicaid program to understand the coverage options available to you.

- Blue Cross Blue Shield: Many plans offered by Blue Cross Blue Shield (BCBS) provide coverage for bariatric surgery, although specific coverage details may vary depending on your plan and location. Some BCBS plans require preauthorization and documentation of medical necessity.

- Aetna: Aetna is another insurance provider that often covers bariatric surgery, particularly for individuals who meet specific criteria and have documented medical necessity. Aetna may require preauthorization and a comprehensive evaluation before approving coverage.

- Cigna: Cigna insurance plans may also cover bariatric surgery for eligible individuals. Coverage details and requirements may vary depending on the specific plan, so it’s essential to review your policy and consult with your healthcare provider.

- UnitedHealthcare: UnitedHealthcare is known to provide coverage for bariatric surgery under certain plans, but coverage details may vary. Like other insurance providers, UnitedHealthcare may require documentation of medical necessity and preauthorization for coverage approval.

Before proceeding with bariatric surgery, it’s crucial to contact your insurance provider directly to understand your specific coverage, requirements, and any out-of-pocket expenses you may incur. Additionally, consulting with your healthcare provider or a bariatric surgery center that works with your insurance provider can help you navigate the process and ensure you have the necessary documentation for coverage approval.

States that Mandate Insurance Coverage for Weight Loss Surgery

Currently, there are 22 states that have laws requiring private insurance plans to cover weight loss surgery if certain medical criteria are met:

- Arizona

- Arkansas

- California

- Connecticut

- Delaware

- Hawaii

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Maryland

- Michigan

- Minnesota

- Missouri

- New Hampshire

- New Jersey

- New Mexico

- North Dakota

- Oregon

- Rhode Island

- West Virginia

The specific requirements vary by state, but generally insurance plans must cover weight loss surgery if the patient has a body mass index (BMI) over 40, or a BMI over 35 with at least one obesity-related condition like diabetes, high blood pressure, or sleep apnea.

States Without Mandated Coverage

The remaining 28 states (and Washington D.C.) do not have laws requiring private insurance plans to cover weight loss surgery, though some plans may still choose to provide coverage.

These include:

Alabama, Alaska, Colorado, Florida, Georgia, Idaho, Kansas, Maine, Massachusetts, Mississippi, Montana, Nebraska, Nevada, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, Wisconsin, and Wyoming.

It’s important to note that even in states with mandated coverage, the specifics of what is covered can still vary by individual insurance plan. Patients should carefully review their policy details or consult with their insurance provider to understand the extent of their weight loss surgery benefits.

Denied for Insurance Coverage? Consider Medical Tourism in Mexico!

If your insurance provider ultimately denies coverage for weight loss surgery, you may want to consider exploring medical tourism in Mexico. Many patients have found that undergoing procedures like gastric sleeve or gastric bypass surgery in Mexico can cost a fraction of the price compared to having the surgery done in the United States.

The quality of care and surgical expertise in Mexico has improved dramatically in recent years, making it a viable and cost-effective option for those who are unable to get their insurance to cover the full cost of weight loss surgery. Be sure to thoroughly vet any Mexican clinics or bariatric surgeons before moving forward, and discuss the logistics and potential risks with your primary care provider.

Stop Dreaming of a Healthier Future – Make it a Reality!

Don’t let cost be a barrier to a healthier future. Discover budget-friendly weight loss surgery in Mexico through Jet Medical Tourism.

Experience life-changing results with minimally invasive procedures like gastric sleeve, gastric bypass, and more – all performed by board-certified surgeons in accredited Mexican hospitals.